Litigation Over Nicotine Isolate Products

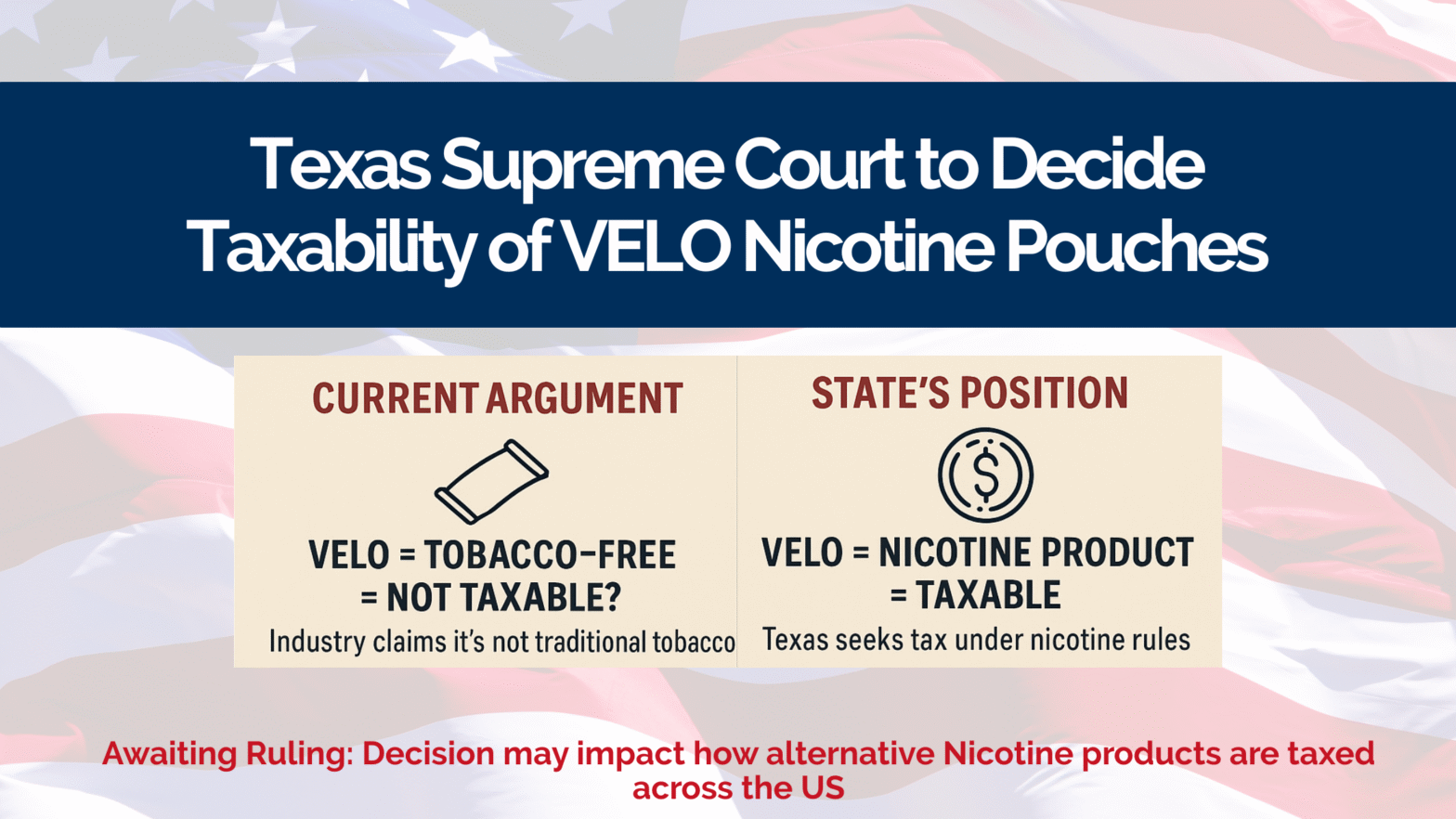

VELO, a brand of R.J. Reynolds, markets pouches and lozenges containing nicotine isolate. As the name suggests, nicotine isolate is nicotine chemically extracted from the tobacco plant; it contains no tobacco leaf material. In 2019, Texas Comptroller Glenn Hegar determined that these products were subject to the state’s Cigars and Tobacco Products Tax, which applies to products “made of tobacco or a tobacco substitute” (Tex. Tax Code § 155.001(15)(E)).

VELO paid the tax under protest and filed suit. In 2023, both the 250th Judicial District Court (Travis County) and the Texas Third Court of Appeals in Austin sided with VELO, finding that:

- Nicotine isolate is not tobacco—so VELO products are not “made of tobacco”

- Nicotine isolate is not an acknowledged “tobacco substitute”

- Therefore, VELO products are outside the statutory definition of a taxable tobacco product

The appeals court emphasized: “tobacco and nicotine aren’t synonymous,” and nicotine isolate doesn’t contain tobacco plant matter

☑️ The State’s Response: Comptroller’s Appeal

The Comptroller of Public Accounts’ office, with new Acting Comptroller Kelly Hancock, as well as AG Ken Paxton, filed an appeal to the Texas Supreme Court, arguing the VELO products are indeed taxable under the following rationale:

* These products have nicotine that is sourced from tobacco.

* The definition within the statute should be interpreted broadly in the context of the statute.

* Exemption would result in lost revenue, as well as frustrate the legislature’s intent to enforce youth protection laws, included within the Health and Safety Code.

Comptroller Hegar warned the case could cost the state hundreds of millions in revenue, and weaken enforcement against sales of flavored nicotine products to minors

Case Review Timeline

The Texas Supreme Court granted review on May 30, 2025. The case is scheduled for oral argument on October 8, 2025

Issues before the Court

The Court must rule on two issues:

Textual question: Does “made of tobacco or a tobacco substitute” include plant-derived nicotine isolate when no tobacco leaf is used?

RJR Vapor says no: Nicotine isolate has no tobacco matter and substitute means other plant material like hemp or cloves not pure chemical extract

The state asserts a broader reading is warranted, anchored by legislative intent and statutory context

Broader Implications

This case may not be unique. It could set precedent for:

- The taxation of other emerging nicotine products, beyond e‑cigarettes, by states.

- Enforcement of underage access and flavored nicotine pouches.

States whose supreme courts uphold the exemption could face lawsuits until the legislature more broadly defines taxable nicotine products

Financial Interests & Health Risks

Texas officials have estimated VELO’s proposed exemption from tax could cost the state hundreds of millions of dollars a year in revenue. Comptroller Hegar has pointed out that the definition of “tobacco product” is also contained in a number of public health laws that prevent the sale of those products to minors

Advocates of the tax also maintain that VELO is in essence a tobacco substitute and should be regulated — and taxed — as such, especially since its flavored products make it attractive to young people.

Statutory & Presumptive Background

- Texas Tax Code § 155.001(15)(E) States that “tobacco products” means “articles that are made of tobacco or of a substitute for tobacco.”

- The court used the Texas presumption of favoring the taxpayer in applying ambiguous tax code sections.

A key point in RJR Vapor’s brief: If “made of tobacco” means “made with tobacco leaf” and VELO has no tobacco leaf, it must be excluded on its plain meaning. Constitutional arguments are made that the State is applying unequal enforcement to separate product categories.

Market Context

The case arrives as the U.S. nicotine pouch market booms, already exceeding $4.09 billion in estimated value in 2024, on pace to expand at almost 30% annual clip through 2030. How the courts view VELO could affect the tax and regulatory landscape throughout the country.

What’s Next?

Oral argument: Oct. 8, 2025

Decision a few months after argument.

If the Supreme Court upholds Texas’ win:

VELO will be subject to taxation.

The same will likely hold true for other nicotine isolate products.

Legislation and regulations governing youth access and public health will be strengthened.

| Key Issue | Legal Question | Potential Outcome |

| Definition of “tobacco product” | Is nicotine isolate within meaning of “made of tobacco or a substitute”? | Court either affirms lower court (exclude) or sides with state (include) |

| Public health enforcement | Does exclusion hinder youth access protections tied to tobacco law? | If excluded, legislature may act to fill gap |

| Tax revenue impact | Will VELO remain exempt from Cigars & Tobacco Tax? | Exclusion may reduce state revenues significantly |

The VEL O nicotine pouch case pending before the Texas Supreme Court will decide whether nicotine products that have no tobacco leaf in them—but are made from tobacco—are subject to Texas’s tobacco taxes. Issues include:

- Textualist statutory interpretation of “made of tobacco or substitute.”

- Constitutional and enforcement issues.

- Billions of dollars and public health impacts at stake.