Every time you file a tax return, you need to watch specific schedules for tax compliance. Taxes require legal formalities and guidelines by the IRS with additional forms and disclosures. And so even if Form 1120 is not subject to a penalty, you could incur a penalty if you fail to file the return that needed those additional disclosures. So, we teach our clients How to fill out tax form 1120 with a Complete Guide.

We here at SG INC CPA believe educating businesses on their tax planning with our competitive strategies enables them to understand taxes better. However, we will uncover some important tips and guidelines through which you can fill out Form Category 1120 yourself to file the IRS.

As this blog covers the concerns and queries of the filling out of Form 1120, so, SG INC CPA guides you on how to fill out Form 1120, U.S. Corporation Income Tax Return. Form 1120 is an Internal Revenue Service (IRS) form used to report the income, gains, losses, deductions, credits, and other relevant financial information of a domestic corporation.

Getting the Form

You may get a copy of Form 1120 at the official IRS website. Additionally, you can find a ready-to-use editable and fillable version at sginccpa.com.

Filling Out the Form

To begin filling out the 1120 tax form, click on the “Fill Online” button, which will redirect you to the PDF online editor. Before starting, note that a domestic corporation must file Form 1120 with the IRS, regardless of whether they have taxable income unless they are required or elect to file a special return instead.

Important Instructions

Download the form 1120 from the IRS official website in PDF format. It is to ensure to follow 1120 instructions to ensure its format and structure remain the same when opened in another application or printed.

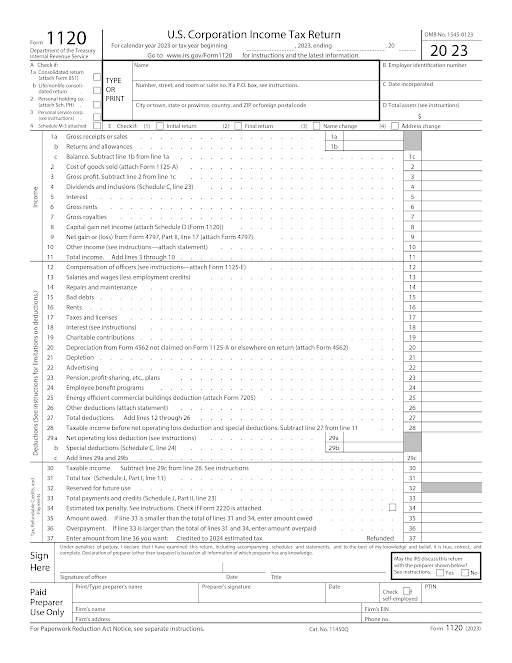

Sections of the Form

- Calendar of Tax Year

Here you will enter the beginning and end of the calendar or tax year. A business tax filer must make sure the beginning date and ending date of the tax year are correct and with no ambiguity.

- Name and Address

Enter the name, address, and other relevant details of your corporation. Through our CPA Tax services, SG INC CPA advises small business owners to be careful with the spellings and letters of the official company or brand name and other info.

- Income Section (Lines 1-10)

This section of the form 1120 contains 10 entries to be filled out. The section incurs the financial information to provide the employer identification number, incorporation date, and total assets as required. SG INC CPA offers professionally reliable assistance to CPAs in identifying the correct business entity codes.

- Report gross receipts

- Sales

- Returns

- Allowances

- Cost of goods sold

- Dividends

- Interest

- Rents

- Royalties

- Other Income (if any)

- Deductions Section (Lines 11-26)

In this fillable entry of the 1120 tax form, the entrepreneur needs to follow the form 1120 instructions 2022 to fill out various deductions such as compensation, salaries, wages, repairs, maintenance, rent, taxes, interest, charitable donations, and others.

- Tax and Payments Section (Lines 27-36)

Here you will calculate the net operating loss deduction, special deductions, total tax, payments, and any amount owed or overpaid.

- Signature Section

Have the representative during Tax Filing Season, the small corporation signs the form and provides necessary details. Our CPAs help the small businesses where and how to fill out the right signatory sections.

- Preparer Section

You may need CPA Tax services to fill details of the preparer section if applicable. This section includes the name of the business owner along with his signature and the date. There must be a tax identification number you have to fill out as well. For better Business Tax Deductions this section is critically important.

Schedule C

This is the section to report dividends, inclusions, and special deductions. You will have to maintain the correctness and fill it out accordingly.

- Schedule J

This schedule directs the formality to calculate tax computation and payment.

- Schedule K

Provide other relevant information about the corporation’s activities and ownership on the 1120 tax form for better understandability.

Schedule L

This schedule reserves the Balance sheets per book.

- Schedule M1

The next section on Form 1120 addresses the reconciliation of income or loss per book with income per return.

- Schedule M2

Analysis of unappropriated retained earnings per book.

Out-of-Form Prerequisites

The following are the prerequisites to crosscheck the monetary values and returns. The CPAs here at SG INC CPA assess and assist in scrutinizing the calculations and deductions.

Validate Deductions

List all deductions from the year in lines 12 through 28. Total deductions and input the amount in line 29. Calculate total taxes paid and tax credits in lines 30 through 35 for tax obligation or refund. A company member signs the tax return, and the preparer fills in the information in the last box.

Attach Extra Schedules (if any)

Incorporate additional sheets for costs for products sold (Timetable A), profits or other particular advantages (Timetable C), and leader pay (Timetable E).

Also include schedules J and K for accounting methods as SG INC CPA has advised on account of additional rate-affecting information.

Paste Supporting Documents

Attach schedules L, M-1, and M-2 if providing a balance sheet with the tax return. Include income loss reconciliation or analysis of unappropriated retained earnings. Once completed, the Form is ready for filing with the IRS. Keep a copy for the corporation’s records.

Review and Submission

Double-check all entered information for accuracy and correctness. Once finished, click on the “Done” button to save, download, and print Form 1120.

Quick Tips for Business Taxpayers:

Form 1120 Filing Steps:

- Start with filling out Form 1120 and providing financial insights about the corporation to the IRS.

- Detail the corporation’s income from sales, dividends, and interest sources.

- Include expenditures such as salaries, rent, and utilities.

Tax Deductions and Rates:

- By subtracting deductions from gross income, SG INC CPA helps you with business tax deductions for taxable income.

- Assist with appropriate tax rate schedules for calculating income tax liability.

- Estimate tax payments, credits, or overpayments based on transaction history.

Additional Information and Assistance:

- Attach more schedules or detailed disclosures of financial activities.

SG INC CPA offers education on how 1120 instructions work for tax filers.

Tax Consultancy Services

Reliable tax consultancy for businesses all over the United States. Wherever you are, you can get help with filling and filing Form 1120.

Contact us for tax assistance in Milpitas, CA, or Dallas, TX, or anywhere in the US. To consult request a quote on our website.