You need to learn accounting to grasp an idea for a Balance Sheet. The balance sheet is one of the three primary financial paradigms used in business and general audit. The other two attributes are the income statement and the cash flow statement, which we will discuss in the next section of this blog.

However, our focus will be on how to prepare the balance sheet, and this blog is going to be a step-by-step guide for business entrepreneurs as well as students and CPAs. SG INC CPA has worked on this guiding balance sheet manual, which our CPAs and bookkeepers took part in to bring you the best knowledge.

Let’s unwrap the step and procedural method ahead to know how it takes to make a balance sheet.

Balance Sheet—at a Glance

A balance sheet, otherwise known as a statement of financial position, is a financial scrutiny report. The scrutinized snapshot of the balance sheet gives us a snapshot of our business’s assets along with liabilities, as well as equity, at a single slot of time.

The Accounting Equation and Basic Balance Sheet

Now, if you know our previous blogs, then you may have heard accounting and bookkeeping guidelines. The Accounting Equation is that the stuff that a business owns is equal to the stuff that a company owes. In other simplified wording, an entrepreneur owns assets while owes liabilities to third parties. The difference between the two is called equity. It is what the entrepreneur owes back to its owners.

So, SG INC CPA elaborates on the accounting equation. The equation goes alongside the assets that are equal to liabilities plus equity. We will be looking at a balance sheet when we take a snapshot of this accounting equation at a single point in time.

What are the Types of Balance Sheets?

SG INC CPA has been working on multiple tiers of balance sheets. We will call the first one the fundamental balance sheet, and as its name signifies, it’s got to balance. That means that total assets must always equal total liabilities and equity. A detailed balance sheet will look something like multiple entries and databases.

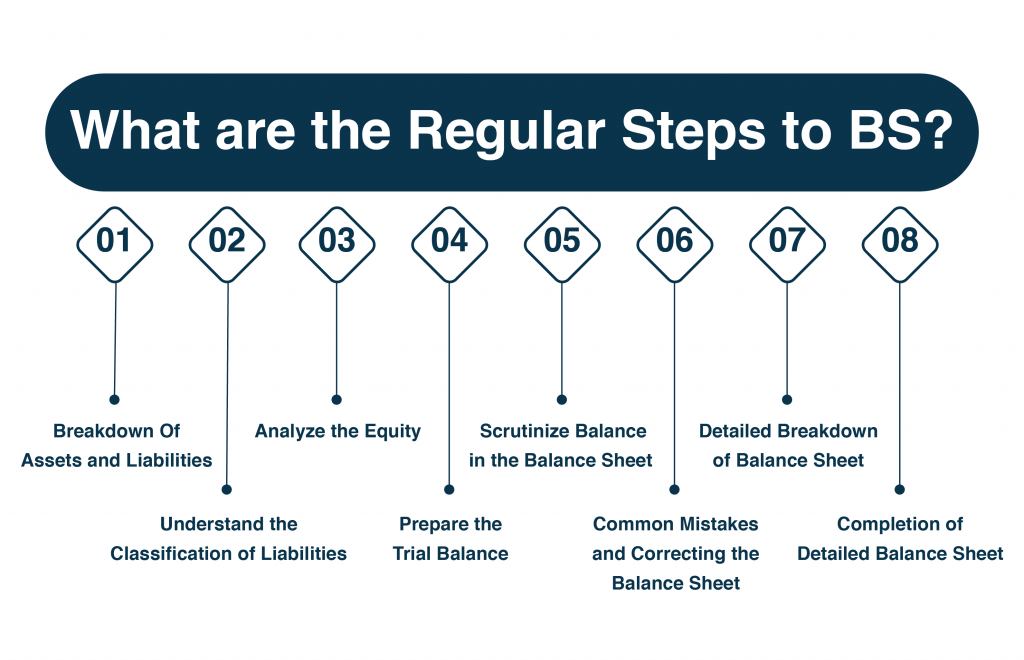

What are the Regular Steps to BS?

In terms of analyzing and preparing the balance sheet (BS), there are some focal steps you need to follow on the way to process and prepare a balance sheet for small businesses. Our CPAs and CFOs have made it upright easier for you to make the balance sheet other than bookkeeping service standards. The following are some steps you can take to make the balance sheet.

Breakdown of Assets and Liabilities

You will expand our assets into current and non-current. Current assets are short-term assets in which things like receivables and prepaid expenses appear. On the other hand, non-current assets are long-term assets. There are two primary sorts: the ones that are intangible and the ones that are tangible touch. Here, we have our adjusted trial balance, and this goes here with our basic debits having equal credits.

We have everything listed out, from our cash all the way down to our interest expense. Now, once again, review the income statement section because we break down how we create the income statement so that we can move our income to the balance sheet.

Understand the Classification of Liabilities

We do the same thing with liabilities. Most commonly, we see the current liabilities as short-term liabilities with payables. These current liabilities often accrue with expenses alongside the deferred revenue. Non-current liabilities are long-term liabilities, such as long-term loans and outstanding balances.

Analyze the Equity

On the other hand, Equity is a different kettle of fish. First, you will have capital contributions for analysis. It is the money invested into the business by the sole owners. For a company with shareholders, you can call this common stock. Then, we have the business’s retained earnings, which are its accumulated profits held for future use.

Prepare the Trial Balance

If you have a balance sheet cheat sheet that summarizes all of this, then you can ask your bookkeeping service how to fill out the balance sheet. How do you make a basic balance sheet?

First, you need another accounting report called a trial balance. This shows us the closing balances for every general ledger account at a point in time. Here’s a trial balance for a restaurant app called XYZ, run at the end of XYZ’s financial year, December 31st. It’s an adjusted trial balance because all adjusting entries have already been posted.

Scrutinize Balance in the Balance Sheet

We can analyze all of XYZ’s accounts and balances under certain circumstances. The debits are on the left, and the credits are on the right when we enter them. We can see that the total debits are at the bottom. We take $$$$$, which exactly matches the total credits. This means that the restaurant trial balance is in balance. So, it is essential because if the trial balance is in balance. Following, the balance sheet also has to balance rank.

Common Mistakes and Correcting the Balance Sheet

It is okay and good to make a balance sheet, but how do we make one? There are two topological procedures to do this. The first one is the right way, while the second one is the wrong way, and SG INC CPA will show you both. We’ll commence with the wrong way because this is an elementary mistake to make. We scrutinize the XYZ Restaurant assets with liabilities and equity accounts. It will pop them in their sections of the balance sheet.

Detailed Breakdown of Balance Sheet

How do we make a detailed balance sheet? We recommend you fill out the balance sheet using the same process. However, first, we will need to divide the aforementioned restaurant’s assets and liabilities into current and non-current status. Under the balancing scrutiny, we will look into the Cash and on-hand accounts receivable.

You also need to check whether there are any other receivables and prepaid expenses associated with all current assets. Some other factors, such as Property or plant to equipment and intangibles, are non-current assets.

Completion of Detailed Balance Sheet

Accounts payable towards the taxes payable are subject to analysis under accrued expenses. You must assess the deferred revenue of all current liabilities and long-term loans as well as non-current liabilities. Common stock is a type of capital contribution in the equity section. Everything you note down is retained earnings, as the restaurant’s profits are held for future use. So, their opening retained earnings at the start of the year with less dividends, plus the restaurant’s net profit in the current year.

Conclusion and Recap

And that’s it! You can pick up all these numbers and put them in our detailed balance sheet. So, we have gone through the current assets of $$$$$ and $x.y million in non-current assets with the current liabilities of $X.Y million and non-current liabilities of $z.h million. Then we have $ some million in common stock.

It is a type of capital contribution, and finally, $some million in retained earnings or profits held for future use. Total assets are equivalent to total liabilities plus equity. Thus, this balance sheet is in balance.