In tricky business rounds and turns, you must be vigilantly prudent about your finances and accounts. Day-to-day business activities involve multiple transactions and accounting affairs. So, a business or manufacturing company requires a CPA for its operations.

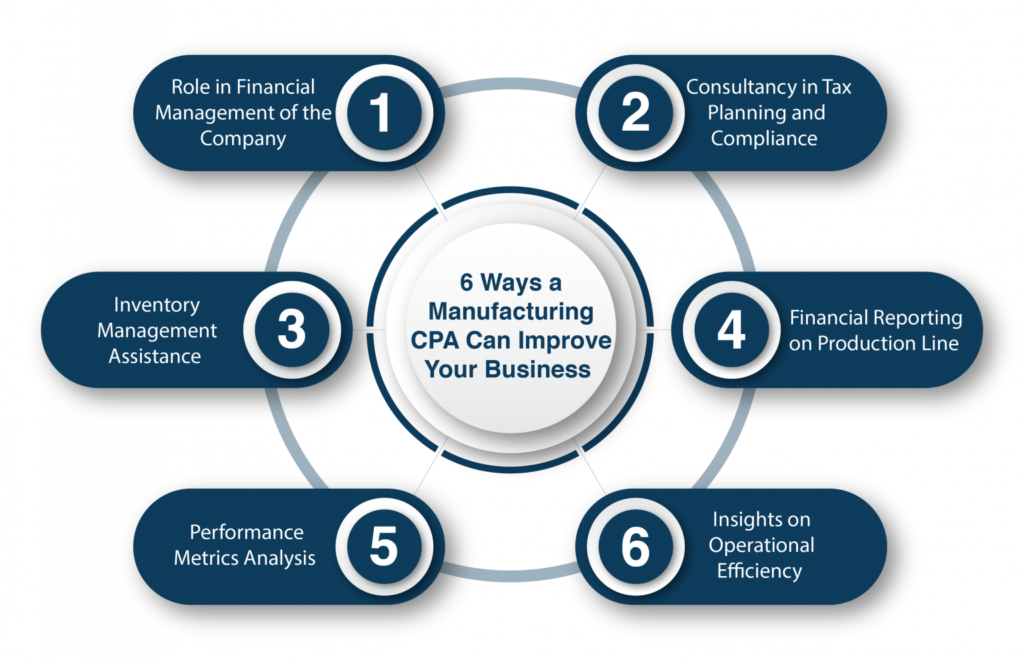

In this discussion, SG INC CPA will share six ways a manufacturing CPA can improve your business. There are some facts and ideas about how a professional CPA’s collaboration can help improve your business performance. Many entrepreneurs leave behind the race because they need to know how to handle their accounts and financial transactions. Thus, let’s explore how manufacturing CPAs assist in boosting your businesses.

Role of A Manufacturing CPA

A Certified Public Accountant (CPA) is a person who specializes in manufacturing. Further, he provides imperative insightful value to businesses in the manufacturing industry.

He uplifts the manufacturing company by offering various financial and strategic services. In other words, a CPA with a specialized background in the manufacturing industry plays a vital role in maintaining the company’s position with financial stability.

There are some specific ways a manufacturing CPA can help businesses. However, more than just accounting and financial record maintenance, CPAs provide other professional assistance to their company work.

The role is other than manufacturing in account taxation; SG INC CPA offers special consultation services to the business.

1. Role in Financial Management of the Company:

In one of the focal job description minutes, a CPA assists businesses in creating accurate and realistic budget drafting. A CPA also forecasts to help manufacturers shape for the future and make informed financial decisions for the healthy financial stability of the company.

He can also implement cost accounting systems to track the budget and finance drainage. He also analyzes production costs to help businesses understand their cost structures and make adjustments for efficiency. This way, a company makes enough profit through previous informed decisions.

2. Consultancy in Tax Planning and Compliance:

Manufacturing firms need to prepare for their tax strategies. Without taxes and other government import and export duties, a manufacturing plant cannot foresee its net profit margin. So, it is the responsibility of the accounts department to develop tax planning strategies to minimize tax liability.

A CPA stands out to be a pillar of the accounts department. CPAs here with us allow the industry to take advantage of available credits and incentives specific to the manufacturing industry.

Moreover, in terms of tax compliance, a CPA verifies tax compliance with complex tax regulations. He streamlines the tax duties with those related to inventory valuation and the depreciation of assets. Keeping the tax rollover for more profit-generating comes also in his role for any industry-specific tax considerations.

3. Inventory Management Assistance:

A CPA helps manufacturing units accurately evaluate inventory and purchase raw product materials. He considers factors such as raw materials, work-in-progress, and finished goods, which are crucial for financial reporting and tax purposes.

Meeting the timeline of the contractor with Just-in-Time (JIT) System falls under his duties. A CPA must implement or optimize JIT inventory systems to reduce carrying costs and improve cash flow.

4. Financial Reporting On Production Line:

Financial statements possess in-depth reports with the outlined company’s economic status. He adds information on the performance-based position over a specific period. These statements comprise several key performance indicators (KPIs) a CPA performs.

He also functionalizes the income statement, balance sheet, and cash flow statement. Manufacturing CPA firm offers insight into a detailed overview of the company’s revenue health alongside expenses, and the firm in Dallas flourishes the liabilities through the cash flows.

Hence, manufacturing CPA firm prepares accurate and timely financial statements to comply with established accounting standards and regulations.

5. Performance Metrics Analysis:

A CPA’s key metrics include production efficiency, quality control, inventory turnover, production cycle times, and cost per unit produced. By defining and tracking these key indicators, CPAs evaluate the performance of the business against predetermined benchmarks and industry standards.

A strategic analysis of performance metrics provides valuable insights into areas of strength and areas needing improvement. CPA further enables the management to make data-driven decisions to optimize processes. Likewise, it enhances productivity and ultimately improves the overall performance of the manufacturing operation.

6. Insights on Operational Efficiency:

A vital professional aspect of a CPA is keeping an eye on the product’s operational efficiency, assembly line, and marketing turnover. A CPA undertakes the insights through the following processes.

Process Improvement

The CPA identifies and recommends enhancements to operational processes to boost efficiency, lower costs, and ultimately enhance overall profitability. This involves a systematic evaluation of existing workflows. CPA takes further responsibility for taking the bottlenecks and implementing strategic changes to optimize business operations.

Now, he explores to compare the performance of a manufacturing business against industry benchmarks to pinpoint areas that may benefit from improvement. Getting performance indicators (KPIs) assessed by manufacturing CPA firms sets the industry standards.

CPA firm Dallas has identified weaknesses in the areas of performance metrics for the growth of the subject business. This process assists in setting realistic performance goals. Such a standard fosters continuous improvement and competitiveness within the manufacturing sector.

Role Other Than Scrutiny & Analysis

Business Planning and Advisory:

Strategic Planning: Strategic planning is an offshoot to assist you in developing long-term business plans. People in a CPA firm tune up the business goals and industry trends.

Risk Management: The core purpose of risk management is to identify and manage financial risks. The parameters help businesses scrutinize the economic uncertainties and changes in market conditions.

Technology Integration:

ERP Systems: A digital system with accounting-pertaining algorithms for implementing and optimizing Enterprise Resource Planning (ERP) systems. The algorithmic guidelines streamline processes to improve data accuracy alongside overall business efficiency.

Mergers cum Acquisitions

Due Diligence: Business tax assistance firms conduct financial reports on the grounds of diligence for mergers and acquisitions. This way, businesses can evaluate target companies’ financial health and potential risks.

Final Nutshell Words

We roll down the scroll with the summary of manufacturing CPA’s utmost imperativeness in helping businesses manage their financial status. The CPA Accountants assist in compliance with regulations to optimize operations. This sets the industry plan for the future decision-making realm.

CPA manufacturing firms extend a hand to help you sustain your manufacturing business with their professional tax assistant team and tax expertise. The CPA team can contribute significantly to a manufacturing company’s success and sustainability.

Frequently Asked Questions

Why Does A Manufacturing Company Need A CPA?

A manufacturing company needs a CPA for its operations. Especially, he navigates the complexities of finances and accounts involved in day-to-day business activities.

What Role Does A Manufacturing CPA Play In Financial Management?

A Manufacturing CPA assists businesses in creating accurate budget forecasting for the future of the business. He further assists in financial decisions to ensure the company’s financial stability.

How Does A CPA Contribute To Tax Planning And Compliance For A Manufacturing Firm?

A CPA develops tax planning strategies to minimize the tax liability of the manufacturing. He further ensures compliance with complex tax regulations.

What Is The Significance Of Inventory Management Assistance By A CPA?

A CPA helps in the accurate valuation of the inventory of the production line. He analyses the factors such as raw materials, work-in-progress, and finished goods. Manufacturing CPAs also implement or optimize JIT inventory systems to reduce carrying costs to improve cash flow.

How Does A CPA Analyze Performance Metrics In The Manufacturing Sector?

A CPA analyzes key performance indicators (KPIs) such as production efficiency, quality control, inventory turnover, and production cycle times. His decisive analysis helps in evaluating business performance against benchmarks and industry standards.